Photo: Bloomberg

After the worst economic collapse in modern history, Venezuela’s economy may finally have hit bottom.

By Bloomberg – Patricia Laya, Alex Vasquez and Erik Schatzker

Jun 22, 2021

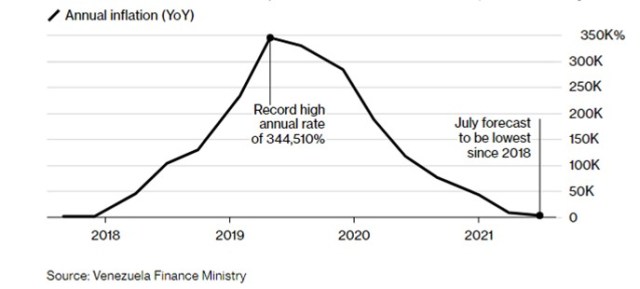

The hyperinflation of years past is still, well, hyper, but it has moderated dramatically from levels that exceeded hundreds of thousands of percentage points a year. And President Nicolas Maduro is confident that output, which has contracted by about 80% since 2012, will expand slightly in 2021, a forecast shared by some private analysts.

The turnaround is mostly due to a combination of reforms straight out of economic orthodoxy: eliminating price controls, reducing subsidies on essentials such gasoline and removing many restrictions on foreign exchange. Today, almost everything in the country is priced in dollars, not bolivars. Even a sign in the biggest slum in Caracas, the capital city, advertises a haircut for $2.

Behind it all is Delcy Rodriguez, the vice president who also serves as finance minister. Together with Patricio Rivera, a former Ecuadoran economy minister who’s been advising her since 2019, she has borrowed from the capitalist playbook to revive an economy damaged by the U.S. sanctions that effectively bar Venezuela from exporting oil.

The result is a policy mix that bears little resemblance to the neo-Marxist “Socialism of the 21st century” that Venezuela pursued under the late Hugo Chavez, Maduro’s predecessor. That system created a byzantine set of currency controls and preferential rates, largely to the benefit of those with government ties, not to mention an enormous black market for dollars. The bolivar lost 99% of its value and inflation spiraled out of control.

“You cannot say that at the time that was socialism, no,” Rodríguez said in a June 11 interview with Bloomberg Television at a poor neighborhood in southwest Caracas. “That was going directly against the people, against the purchasing power of the people.”

Combined with severe limits on lending and on money-printing by the central bank, the ad hoc dollarization of the economy has kept prices rising at a much slower rate. Annual inflation is down to 2,266% a year from more than 300,000% in 2019; on a monthly basis, price gains slowed even further to about 20% in May.

One challenge is keeping enough U.S. currency in circulation. Since last year, the central bank has been sending millions of dollars — and, to a lesser extent, euros — in cash to local lenders to exchange with clients. That helped stop the bolivar from plummeting in the parallel foreign-exchange market that most Venezuelans use.

Hyperinflation

Venezuela’s annual consumer price increases forecast at 2,900% for July.

The reforms have also helped spur domestic demand, according to a Credit Suisse Group AG note in April. The Swiss bank forecast as much as 4% growth in gross domestic product, barring any major Covid-19 lockdowns. Caracas-based consultancy firm Econometrica sees gross GDP expanding as much as 8%, Director Henkel Garcia said.

The nation rarely publishes its economic data, and when it does it usually comes with months of delay, meaning most economists are usually left in the dark when making their own forecasting for economic growth or inflation.

In another tilt away from socialism, private companies have displaced the state as dominant force in many parts of the economy. They accounted for 92% of the Venezuela’s raw materials and food imports in 2020 compared to 25% the previous year, according to government figures seen by Bloomberg News. That has allowed the Maduro government to close part of its huge fiscal gap.

Shifting Gears

Venezuelan private sector’s share of raw material imports hit 92% in 2020.

Small Relief

To be sure, the green shoots are only a small relief. The country is still reeling from two decades of economic mismanagement and four years of crippling sanctions. Most of the population doesn’t have access to dollars.

…

Read More: Bloomberg – Maduro’s reluctant reforms may halt Venezuelan Economic Freefall

…