Lulu Garcia-Navarro talks with Harvard professor Jason Furman, a once top economic advisor to former president Barack Obama, about inflation and the U.S. economy.

By NPR

Jul 18, 2021

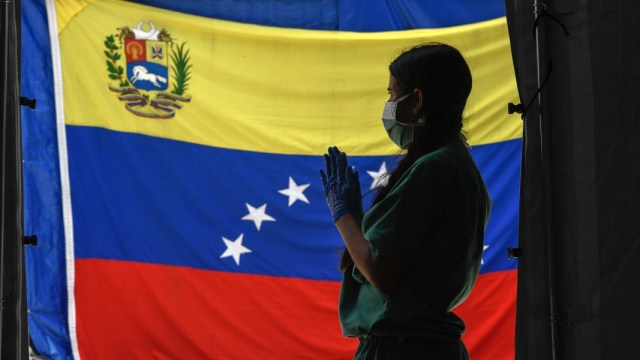

Lulu García-Navarro, Host: Out-of-control inflation has decimated economies around the world. No, the United States is not Venezuela or Lebanon, where powdered baby milk now costs a quarter of the monthly salary of an average working person, but there are things to be worried about. The Consumer Price Index, a barometer for inflation, saw its biggest jump in 13 years this June here in the United States. Jason Furman led the Council of Economic Advisers in the Obama White House and now teaches economic policy at Harvard. And he joins us now. Good morning.

Jason Furman: Morning.

García-Navarro: Are we entering an inflationary phase?

Furman: We certainly have a lot of inflation. Over the last six months, we had 3.6% inflation. Normally, it would take two years for prices to increase that much. But, you know, as you noted in your intro, this is very, very far from, you know, the types of catastrophes you see around the world.

García-Navarro: Sure. But it is, of course, a worry. I mean, Neel Kashkari is in charge of the Minneapolis Fed, and we heard a conversation on this program yesterday that he had with my co-host, Scott Simon. He told Scott that some price spikes, like for cars, may last a couple of years because it takes that long to ramp up computer chip production. Let’s listen.

Neel Kashkari: But I’m not seeing any evidence yet that we’re going to have sustained high inflation beyond this reopening period. Whether that’s six months or a year or 18 months, I’m not sure.

García-Navarro: So a couple of years for cars, possibly 18 months for other stuff, but that’s a lot of money out of people’s pockets.

Furman: Yeah. I think I might be more worried that some of the inflation is persistent than Neel is. Everyone agrees that we’re not going to continue to see prices rising 3.6% every six months. That’s going to come down. But I don’t think it’s going to come down all the way to the 2% inflation that the Fed has historically wanted. I think there’s years’ worth of pressures. Both demand, people buying more – and supply, the economy can’t produce as much as it used to. And the combination of those, I think, is going to last a while.

García-Navarro: Are you worried about that?

Furman: I am worried about it but not terrified about it. Just to understand, a lot of economists – and I count myself as one of them – think steady 3% inflation that was predictable and controlled at 3% would actually be better than steady, predictable 2% inflation that we’ve had in the past. The reason for that is that it gives the Fed a little bit more room to combat recessions and would make recessions less bad. So if we could engineer that outcome, that would be great. The problem is it’s really tricky getting from here to there. If the Fed overreacts, it might cause a recession. If wages don’t go up, workers could be hurt by this. So I think there’s a lot of perils here. But there’s also, you know, a path to navigate through it, and that’s what I hope happens.

…

Read More: NPR – Inflation is out of control in Lebanon and Venezuela. Could it happen here?

…